Santander check deposit services offer a convenient way for customers to manage their finances without visiting a physical branch. Whether you're depositing checks through mobile banking or utilizing ATMs, Santander ensures a seamless experience tailored to modern banking needs. This article delves into everything you need to know about Santander's check deposit options, helping you maximize convenience and efficiency.

In today's fast-paced world, banking has evolved significantly. Traditional methods of depositing checks are gradually being replaced by innovative digital solutions. Santander check deposit services exemplify this shift, providing customers with flexible options to handle their financial transactions effortlessly.

As one of the leading global financial institutions, Santander is committed to delivering reliable and secure banking services. This article explores the various ways you can deposit checks with Santander, including mobile check deposit, ATM deposits, and more. By understanding these options, you can enhance your banking experience and optimize your financial management.

Read also:Unveiling The Taboo A Candid Look At Hot Babe Farting

Table of Contents

- Introduction to Santander Check Deposit

- Mobile Check Deposit with Santander

- ATM Check Deposit

- Branch Check Deposit

- Eligibility Requirements

- Fees and Charges

- Security Measures for Santander Check Deposits

- Benefits of Santander Check Deposit Services

- Tips for Efficient Check Deposits

- Frequently Asked Questions

- Conclusion

Introduction to Santander Check Deposit

Santander check deposit services cater to a diverse range of customer needs, ensuring that everyone can access convenient banking solutions. Whether you're a busy professional or a small business owner, these services are designed to simplify your financial transactions.

Why Choose Santander?

Santander stands out for its commitment to customer satisfaction and technological innovation. The bank offers state-of-the-art tools and resources to make check deposits as easy as possible. By leveraging advanced technology, Santander ensures that your deposits are processed quickly and securely.

Key Features of Santander Check Deposit

Here are some of the standout features of Santander's check deposit services:

- Mobile banking app for on-the-go deposits

- Extensive ATM network for convenient access

- Dedicated customer support for assistance

Mobile Check Deposit with Santander

One of the most popular ways to deposit checks with Santander is through the mobile banking app. This service allows you to deposit checks from virtually anywhere, making it an ideal solution for those who prefer digital banking.

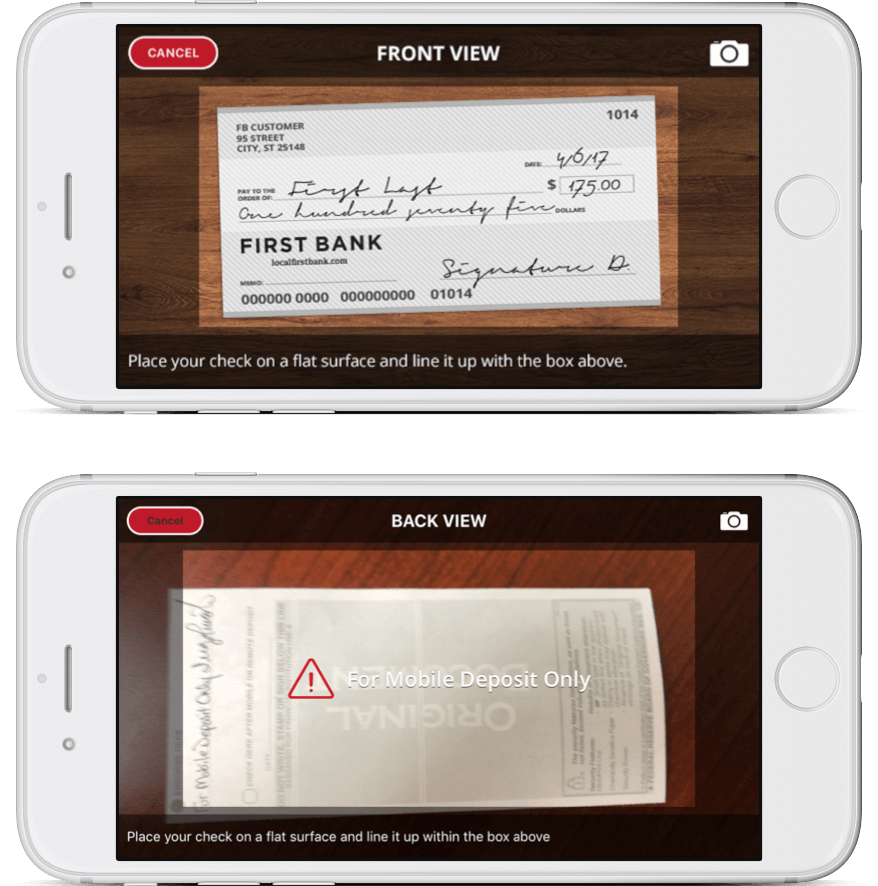

How It Works

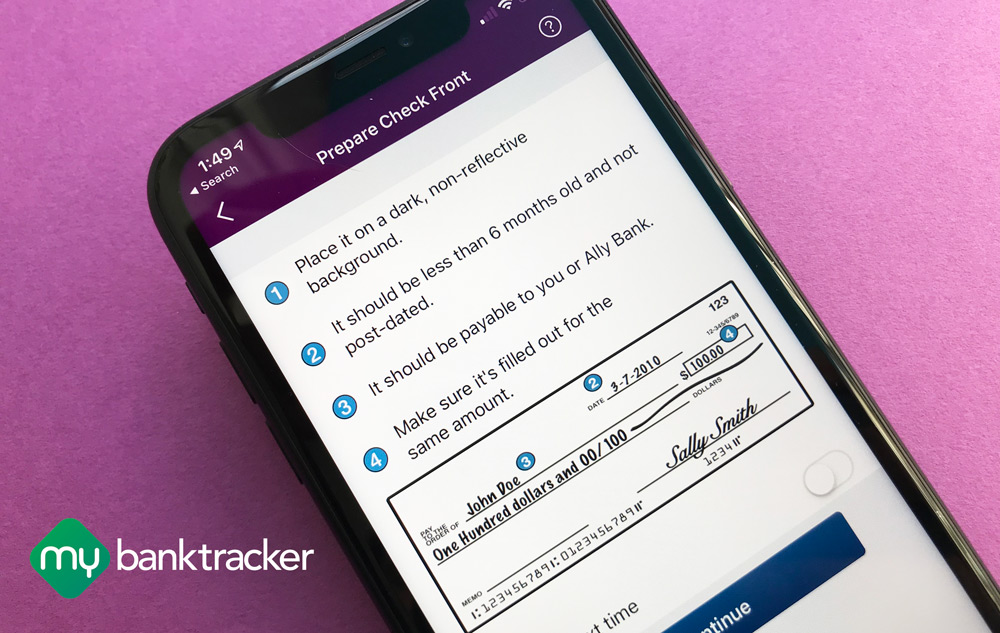

Depositing checks via the Santander mobile app is a straightforward process:

- Log in to your Santander mobile banking app

- Select the "Deposit Check" option

- Take clear photos of the front and back of the check

- Confirm the deposit amount and submit

Advantages of Mobile Check Deposit

Mobile check deposit offers several advantages:

Read also:Ronnie Ms Pacman The Gaming Legend Redefining The Industry

- Time-saving: No need to visit a branch or ATM

- Convenience: Deposit checks anytime, anywhere

- Security: Advanced encryption ensures safe transactions

ATM Check Deposit

For those who prefer a more traditional approach, Santander's ATM network provides an excellent alternative. With thousands of ATMs across the country, you can easily deposit checks without waiting in long lines at a branch.

Steps to Deposit Checks at an ATM

Follow these simple steps to deposit checks at a Santander ATM:

- Insert your Santander debit card into the ATM

- Select the "Deposit" option

- Insert the check into the ATM slot

- Confirm the deposit amount and complete the transaction

Benefits of ATM Deposits

ATM deposits offer the following benefits:

- Accessibility: ATMs are available 24/7

- Speed: Deposits are processed quickly

- Reliability: ATMs provide a secure and efficient deposit method

Branch Check Deposit

While digital solutions dominate the banking landscape, Santander still offers the option to deposit checks in person at a branch. This method is ideal for those who prefer face-to-face interactions with banking staff.

What to Expect at a Santander Branch

When visiting a Santander branch to deposit a check, you can expect:

- Personalized assistance from knowledgeable staff

- Immediate confirmation of your deposit

- Access to additional banking services

Tips for Branch Deposits

To make the most of your branch visit:

- Bring your check and valid identification

- Arrive during off-peak hours for shorter wait times

- Prepare your deposit slip in advance

Eligibility Requirements

Not all Santander customers may be eligible for check deposit services. Understanding the eligibility criteria is essential to ensure a smooth deposit process.

Who Can Use Santander Check Deposit Services?

Eligibility depends on factors such as:

- Account type: Checking or savings account holders

- Account status: Active and in good standing

- Mobile app access: For mobile check deposits

How to Verify Eligibility

To confirm your eligibility, contact Santander customer support or consult your account details in the mobile app.

Fees and Charges

While Santander strives to provide cost-effective banking solutions, certain fees may apply to check deposits. It's important to understand these charges to avoid unexpected expenses.

Common Fees for Check Deposits

Some potential fees include:

- Overdraft fees if the check bounces

- Foreign check processing fees

- ATM network fees for non-Santander ATMs

Ways to Avoid Fees

To minimize costs:

- Ensure checks are drawn from reputable sources

- Use Santander ATMs for deposits

- Monitor your account balance regularly

Security Measures for Santander Check Deposits

Santander prioritizes the security of its customers' financial transactions. By implementing robust security measures, the bank ensures that your check deposits are protected from unauthorized access and fraud.

How Santander Protects Your Deposits

Santander employs the following security features:

- Two-factor authentication for mobile app access

- Encrypted data transmission

- Real-time fraud monitoring

Best Practices for Secure Deposits

To enhance your security:

- Keep your mobile app updated

- Use strong, unique passwords

- Report any suspicious activity immediately

Benefits of Santander Check Deposit Services

Santander check deposit services offer numerous advantages that cater to the needs of modern banking customers.

Top Benefits

Here are some of the key benefits:

- Convenience: Deposit checks anytime, anywhere

- Speed: Quick processing times for deposits

- Security: Advanced protection for your transactions

Why Customers Love Santander

Customer testimonials highlight the ease of use, reliability, and customer support provided by Santander's check deposit services.

Tips for Efficient Check Deposits

To make the most of Santander's check deposit services, consider the following tips:

- Endorse checks properly before depositing

- Double-check deposit amounts to avoid errors

- Utilize mobile alerts to track deposit status

Common Mistakes to Avoid

Some common errors to avoid include:

- Depositing checks with incomplete or incorrect information

- Using non-Santander ATMs for deposits

- Delaying deposits, which may lead to bounced checks

Frequently Asked Questions

Q1: How long does it take for a check to clear?

A: The clearing time depends on the type of check and the amount. Most checks clear within 1-2 business days.

Q2: Can I deposit checks from other countries?

A: Yes, but foreign checks may incur additional processing fees and longer clearing times.

Q3: Is there a limit on the number of checks I can deposit?

A: There is no specific limit, but large volumes of checks may require additional verification.

Conclusion

Santander check deposit services provide a comprehensive solution for managing your finances efficiently. By offering mobile, ATM, and branch deposit options, Santander ensures that customers can choose the method that best suits their needs. With advanced security measures and user-friendly tools, Santander remains a trusted partner in your banking journey.

We encourage you to explore Santander's check deposit services and experience the convenience they offer. Share your thoughts in the comments below or explore other informative articles on our site for more insights into banking solutions.

Data Sources:

Santander US

FDIC

Consumer Financial Protection Bureau